Why I Finally Moved On From Getting Ripped Off By Old Banks

For years I stayed with a traditional bank because it felt safe. It was familiar. It had branches everywhere. I assumed switching would be a hassle, so I ignored the small problems. Then I looked closely at how my bank actually worked and something became clear. It was slowing me down. It was charging for things that should be free. It was built around its own priorities, not mine.

That was the moment I decided to move on. Once I switched, the difference was immediate.

What old banks get wrong

The data is simple and uncomfortable.

The Consumer Financial Protection Bureau reports that major banks collect more than 12 billion dollars a year in overdraft and NSF fees. Many still charge 10 to 15 dollars per month for basic checking unless you keep a high minimum balance. The average big-bank savings rate is still around 0.01 percent.

Transfers remain slow because banks choose to make them slow. The Federal Reserve has shown that timing depends on bank policy, not technology limits. Many banks still cannot automate recurring payments to individuals. Apps are outdated. Support lines are slow and scripted.

This is not about lack of ability. It is about lack of incentive. Traditional banks profit when customers accept friction and do not question it.

How deregulation weakened the CFPB and made banking worse

A major reason old banks still operate this way is that the nation’s strongest consumer watchdog was weakened under a federal deregulation push during the Trump administration. The stated goal was to reduce government burden and make systems “more efficient.” What actually happened was the opposite.

The CFPB was created after the 2008 crisis to protect consumers from predatory banking. In its early years it returned billions to regular people by enforcing rules against deceptive credit cards, abusive payday lenders, illegal overdraft practices, and inaccurate credit reporting.

That progress changed sharply after 2017.

What actually changed

Leadership was handed to critics of the agency

Mick Mulvaney, who had previously argued the CFPB should not exist at all, was placed in charge. Under his direction:

• New enforcement was paused • New investigations were paused • Hiring was frozen • Rulemaking was stalled • The CFPB’s independent budget was reduced

A watchdog cannot protect consumers if it is prevented from acting.

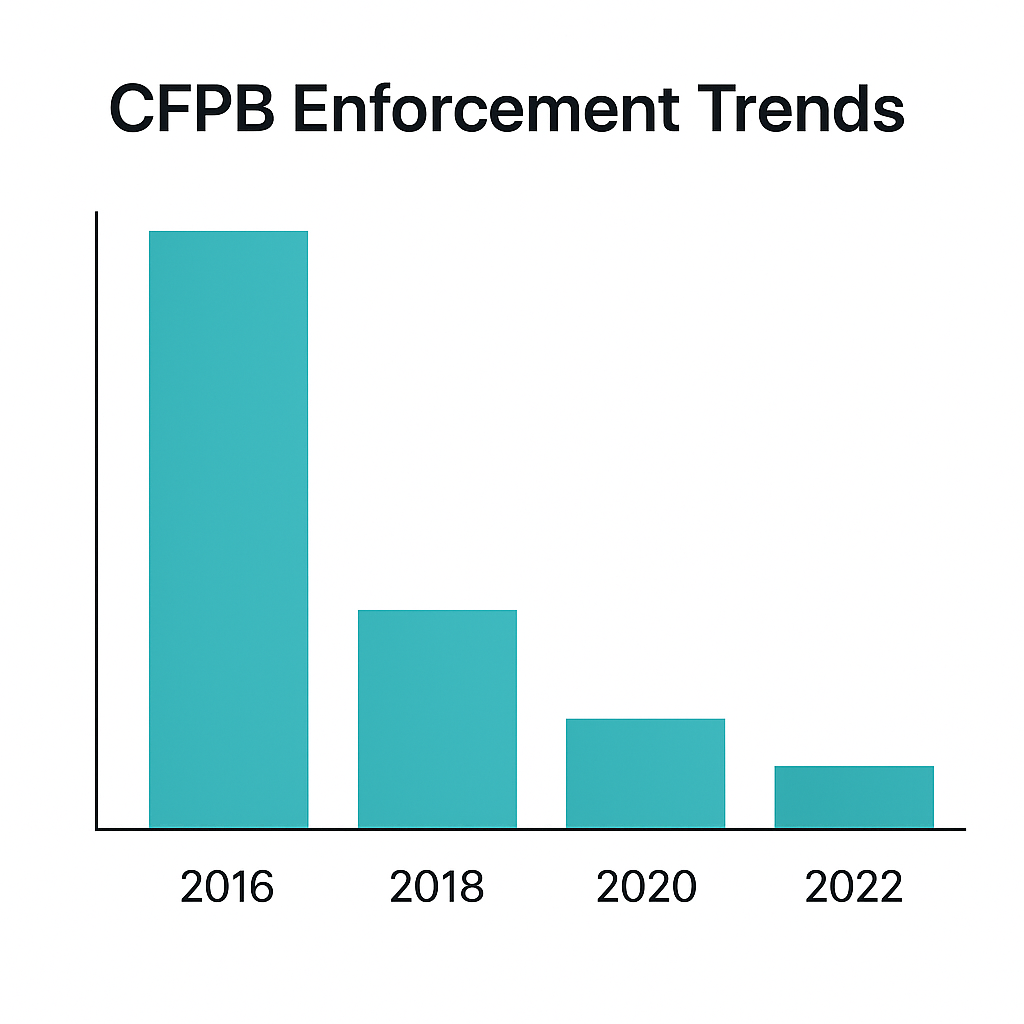

Enforcement dropped more than 75 percent

Public reporting from sources like the Associated Press and the Wall Street Journal shows that the CFPB’s enforcement activity fell dramatically:

• Cases were dropped or quietly closed • Penalties for major violations shrank • Investigations into known abuses stalled • Oversight of banks and credit bureaus weakened significantly

When oversight drops, bad behavior becomes easier.

Payday lending protections were rolled back

Rules designed to stop debt traps were removed. Lenders no longer had to verify a borrower’s ability to repay. The payday lending industry benefited. Consumers did not.

Arbitration protections were eliminated

A rule limiting forced arbitration was repealed. This allowed banks to block class action lawsuits and forced consumers into private dispute systems that favor the institution.

Credit reporting oversight weakened

Efforts to hold Equifax and other bureaus accountable slowed after major breaches and errors. Consumers lost protections around data accuracy and dispute resolution.

Did this save money or make government more efficient? No.

The CFPB is funded through the Federal Reserve, not the taxpayer budget. Weakening it did not reduce government spending or lower taxes.

What did increase were the costs to consumers.

With less enforcement:

• Hidden fees grew • Overdraft traps persisted • Errors took longer to fix • Abusive loan structures reappeared • Banks had less pressure to modernize systems

Deregulation did not make banking better. It made it harder for people to recover money when banks failed them.

This environment allowed old banks to continue operating with outdated systems, slow processes, and fee-heavy models without fear of accountability.

The moment I chose to switch

My breaking point was simple. I needed to automate a recurring payment to a real person. My legacy bank could not do it. There was nothing unusual about the request. The bank just had not evolved.

That was the wake-up call. If a bank cannot handle basic modern workflows, why should I rely on it?

What modern banking does better

Modern financial tools solve nearly every problem legacy banks ignore.

You get:

• No maintenance fees • Fast or same-day transfers • Real automation • High-yield accounts for idle cash • Clear notifications • Clean digital interfaces • Predictable payment flows

They are built around the user, not the institution.

The simple structure that works

The solution is not to find one perfect bank. It is to use the right account for each role.

Use one stable checking account for major bills and company payments. Use one modern account that supports automated person-to-person payments. Use one high-yield account for idle cash.

This small shift removes every point of friction that old banks struggle with.

What changed after switching

The improvement was immediate.

• No monthly fees • No surprise charges • Faster transfers • Better yield • Cleaner automation • More clarity • Less hassle

Currently the government is not looking out for out for you or protecting you at all. All the fairness, protection and help is being stripped and its up to you to take care of yourself. Thats what the CFPB was for, but its been disassembled and destroyed now. Thanks Elon and Doge for ripping out all consumer protections, fuck all the regular people... Hype up a pretend buck saved last quarter to cost average Americans more tomorrow. Government Inefficiency to the max.

Why you should consider moving on

Most people stay with old banks because switching feels annoying. The truth is that the cost of staying is much higher. You lose time. You lose yield. You lose control. You accept outdated tools that fit a world that no longer exists.

You do not need to stay with a bank just because it is familiar. You can build something better with a simple structure and a few clean moves. The value shows up fast. The stress drops immediately.

If your bank is slowing you down, it is time to move on. You deserve a system that keeps up with your life.

Comments ()